demo-szet.ru

Prices

What State Has The Highest Car Insurance Rates

Rates evaluated March Minimum coverage limits typically have three values, which correspond to three different types of injury/damage. For example. Oklahoma has the highest average cost of homeowners insurance in the U.S. at $5, per year. Below, you'll see the top five most expensive states for. It's followed by Iowa ($), Wisconsin ($), Idaho ($1,) and North Carolina ($1,). 4: West Virginia. If having high car insurance rates were a contest. Car insurance costs are a substantial expense, and where you live has a substantial effect on rates. The most expensive state for car insurance is Michigan. It's followed by Iowa ($), Wisconsin ($), Idaho ($1,) and North Carolina ($1,). 4: West Virginia. If having high car insurance rates were a contest. have the highest rates when age is a significant factor. Gender: Most states allow insurance companies to differentiate between female and male drivers. Average car insurance cost by state with Progressive. Take a closer look at where your state falls regarding average car insurance cost. Map of United States. Michigan is the most expensive state to own a vehicle in it's ridiculous and unfair for what our vehicles have to endure compared to other. Why Does Louisiana Have the Second-Most Expensive Car Insurance Rates? In the state of Louisiana, residents must pay high car insurance premiums for a variety. Rates evaluated March Minimum coverage limits typically have three values, which correspond to three different types of injury/damage. For example. Oklahoma has the highest average cost of homeowners insurance in the U.S. at $5, per year. Below, you'll see the top five most expensive states for. It's followed by Iowa ($), Wisconsin ($), Idaho ($1,) and North Carolina ($1,). 4: West Virginia. If having high car insurance rates were a contest. Car insurance costs are a substantial expense, and where you live has a substantial effect on rates. The most expensive state for car insurance is Michigan. It's followed by Iowa ($), Wisconsin ($), Idaho ($1,) and North Carolina ($1,). 4: West Virginia. If having high car insurance rates were a contest. have the highest rates when age is a significant factor. Gender: Most states allow insurance companies to differentiate between female and male drivers. Average car insurance cost by state with Progressive. Take a closer look at where your state falls regarding average car insurance cost. Map of United States. Michigan is the most expensive state to own a vehicle in it's ridiculous and unfair for what our vehicles have to endure compared to other. Why Does Louisiana Have the Second-Most Expensive Car Insurance Rates? In the state of Louisiana, residents must pay high car insurance premiums for a variety.

The State Insurance Report · The states with the highest projected insurance premiums. 1. Florida · The states currently paying the most for car insurance 2. Insurance Fraud: Florida has a higher rate of insurance fraud compared to other states. Fraudulent claims contribute to increased costs for everyone. How much. Mississippi has the highest rate of car accident deaths per , people and the highest proportion of uninsured drivers of any state. However, the cost. Our study of car insurance costs across the U.S. found that Maine residents have the cheapest average annual rate: $ per year. Idaho is the next cheapest at. Delaware drivers pay about $ monthly for full coverage, a 9% increase since June The state has the seventh-highest population density in the country. Louisiana had the highest average car insurance cost of $1, According to the latest III data, that's about $ more expensive than the national average. If you're wondering about the average cost of car insurance in Florida, you're in the right place. Florida's car insurance rates are among the highest in. Oklahoma has the highest average cost of homeowners insurance in the U.S. at $5, per year. Below, you'll see the top five most expensive states for. Michigan is the most expensive state to own a vehicle in it's ridiculous and unfair for what our vehicles have to endure compared to other. Maine has the most reasonable auto insurance rates in the country, followed by Wisconsin and Idaho. The primary common factor is that all three. Florida is a notoriously tough market for homeowners insurance due to the state's risk level. The Sunshine State's long coastline and narrow shape mean that. Oklahoma has the highest average cost of homeowners insurance in the U.S. at $5, per year. Below, you'll see the top five most expensive states for. State farm is one of the largest auto insurers based on market share and has an excellent reputation for customer satisfaction. It offers 13 discounts. Each insurer has thousands of auto insurance rates in every state it does premiums, while cars used for business generally have higher premiums. The type of coverage. The coverages you choose may affect the cost of your car insurance premium. Most states have some auto insurance requirements, typically. Rates evaluated March Minimum coverage limits typically have three values, which correspond to three different types of injury/damage. For example. Louisiana, Florida, New York, Nevada, and Michigan are the most expensive car insurance states. On average, residents in these states pay more than $2, Delaware drivers pay about $ monthly for full coverage, a 9% increase since June The state has the seventh-highest population density in the country. Most Expensive USA States for Car Insurance · 1. Michigan. With an average of $ per year; Michigan is at the top of our list of highest car insurance rates. Urban neighborhoods typically have higher rates of accidents, theft and vandalism than more rural areas, which means premiums may be higher. Your age. Your age.

Dungeon Siege

This site is for those who love to play or mod the Dungeon Siege games. Don't forget to check the rules and help pages if you are a new visitor. Description. Dungeon Siege combines the immersive elements of a role-playing game with over-the-top intensity and non-stop action. Dungeon Siege plunges you. Dungeon Siege combines the immersive elements of a role-playing game with over-the-top intensity and non-stop action. Dungeon Siege combines the immersive elements of a role-playing game with over-the-top intensity and non-stop action. Dungeon Siege plunges you into a. In a quick interview with Eurogamer, Dungeon Siege creator Chris Taylor points out the growing success of the PC platform (particu. A full weekend of dungeon synth. Join us for three days of mystifying sounds and daring performances. We hope to see you there! Dungeon Siege is a computer role-playing game developed by Gas Powered Games and published by Microsoft Game Studios. Chris Taylor (from Total Annihilation). The Dungeon Siege Collection contains every Dungeon Siege Game released for PC, as well as the incredibly successful DLC for Dungeon Siege III - Treasures. In Dungeon Siege III: Treasures of the Sun, players will extend their journey and travel beyond the borders of Ehb to an all-new environment: the Aranoi. This site is for those who love to play or mod the Dungeon Siege games. Don't forget to check the rules and help pages if you are a new visitor. Description. Dungeon Siege combines the immersive elements of a role-playing game with over-the-top intensity and non-stop action. Dungeon Siege plunges you. Dungeon Siege combines the immersive elements of a role-playing game with over-the-top intensity and non-stop action. Dungeon Siege combines the immersive elements of a role-playing game with over-the-top intensity and non-stop action. Dungeon Siege plunges you into a. In a quick interview with Eurogamer, Dungeon Siege creator Chris Taylor points out the growing success of the PC platform (particu. A full weekend of dungeon synth. Join us for three days of mystifying sounds and daring performances. We hope to see you there! Dungeon Siege is a computer role-playing game developed by Gas Powered Games and published by Microsoft Game Studios. Chris Taylor (from Total Annihilation). The Dungeon Siege Collection contains every Dungeon Siege Game released for PC, as well as the incredibly successful DLC for Dungeon Siege III - Treasures. In Dungeon Siege III: Treasures of the Sun, players will extend their journey and travel beyond the borders of Ehb to an all-new environment: the Aranoi.

The world of Dungeon Siege allows for anyone to become anything. Any character can pick up or leave any profession at any time, becoming the culmination of all. Its polished interface, accessible gameplay, and exceptional graphics make Dungeon Siege a first-rate action RPG. Product details · For the first time, play DUNGEON SIEGE on high-def consoles · Players will be able to adventure by themselves or with friends in co-op. Dungeon Siege 3 is an Action RPG that seamlessly blends intuitive fast-paced gameplay with a robust RPG system featuring a large selection of abilities. r/DungeonSiege: A community centered around Dungeon Siege. Dungeon Siege is an action role-playing game developed by Gas Powered Games. Out of the dungeon, and into the fire! Get ready for action-packed RPG gameplay with the Dungeon Siege I + II Pack - featuring two Steam PC titles to. Dungeon Siege plunges you into a continuous 3D fantasy world where you face off against an army of evil that has been unleashed. In Dungeon Siege II, you will be called on to again wield sword and spell to save the world from a growing abomination many years in the making. Release Date, Trailers, News, Reviews, Guides, Gameplay and more for Dungeon Siege III. Dungeon Siege III is an action role-playing game developed by Obsidian Entertainment. It was published by Square Enix for PlayStation 3. Dungeon Siege II features the story, characters, skills, powers, creatures, items, magic pets, interface, multiplayer. Dungeon Siege is an award-winning RPG franchise set in the medieval kingdom of Ehb. The series. Dungeon Siege® combines the immersive elements of a role-playing game with over-the-top intensity and non-stop action. Dungeon Siege plunges you into a. Dungeon Siege is an immense game, but its game engine itself is simplistic. There are three statistics (Strength, Dexterity and Intelligence) and four skills. In the Name of the King: A Dungeon Siege Tale: Directed by Uwe Boll. With Jason Statham, Leelee Sobieski, John Rhys-Davies, Ron Perlman. Dungeon Siege: Directed by Chris Taylor. With Yuri Lowenthal, Tara Platt. On a tiny farm in the Kingdom of Ebh, a mysterious attack by the peace-loving Krug. Dungeon Siege® combines the immersive elements of a role-playing game with over-the-top intensity and non-stop action. Dungeon Siege plunges you into a. It's been a generation since you vanquished the evil that plagued the Land of Ehb, and now a new menace has awakened. In Dungeon Siege II, the sequel to the. Gas Powered Games' Chris Taylor discusses his acre-and-a-half farm, the company's founding principles, the development of Dungeon.

What Are Yields In Stocks

Yield is a general term that relates to the return on the capital you invest in a bond. Price and yield are inversely related: As the price of a bond goes. Dividends and Yields Unlike interest on bonds or certificates of deposit that remains constant, dividends on stock can be reduced or eliminated in lean. Yield is defined as an income-only return on investment (it excludes capital gains) calculated by taking dividends, coupons, or net income and dividing them by. The dividends earned from stocks or the interests earned on debt instruments are considered for yield calculation. Yield is expressed as the percentage of the. Build a more complete portfolio with private markets. If you're only invested in stocks and bonds, you may be leaving performance on the table. The Yield Gap is the difference between the yields of government-issued securities and the average dividend yield on stock shares. For companies that pay dividends, the Dividend Yield can give you an idea how a company's dividend payments relate to its stock price. What Is Dividend Yield? If your goal is creating an income stream, you might simply look for stocks with above-average dividend yields over a longer period, says Cabacungan. But if. For companies that pay dividends, the Dividend Yield can give you an idea how a company's dividend payments relate to its stock price. What Is Dividend Yield? Yield is a general term that relates to the return on the capital you invest in a bond. Price and yield are inversely related: As the price of a bond goes. Dividends and Yields Unlike interest on bonds or certificates of deposit that remains constant, dividends on stock can be reduced or eliminated in lean. Yield is defined as an income-only return on investment (it excludes capital gains) calculated by taking dividends, coupons, or net income and dividing them by. The dividends earned from stocks or the interests earned on debt instruments are considered for yield calculation. Yield is expressed as the percentage of the. Build a more complete portfolio with private markets. If you're only invested in stocks and bonds, you may be leaving performance on the table. The Yield Gap is the difference between the yields of government-issued securities and the average dividend yield on stock shares. For companies that pay dividends, the Dividend Yield can give you an idea how a company's dividend payments relate to its stock price. What Is Dividend Yield? If your goal is creating an income stream, you might simply look for stocks with above-average dividend yields over a longer period, says Cabacungan. But if. For companies that pay dividends, the Dividend Yield can give you an idea how a company's dividend payments relate to its stock price. What Is Dividend Yield?

The Dividend Yield formula is simple: Dividends per Share divided by the Current Share Price. Investors who aim to earn income from their stocks in addition. The Dividend Yield formula is simple: Dividends per Share divided by the Current Share Price. Investors who aim to earn income from their stocks in addition. □ Corporate Bond Yield □ US Stock Dividend Yield. As of 12/31/ Data Percentage of S&P Stocks with Dividend Yields Greater than. Year. Dividend Yield is the ratio between the dividend paid per share (DPS) and the current stock price of the issuer. A stock's dividend yield is calculated with a simple formula. Here, you can learn how to calculate yield for annual, quarterly and monthly dividends. Bond yields trended down following the global financial crisis, making stocks seem like almost the only choice for investors seeking attractive returns. In fact. Yields on Stocks: For stocks, yield is calculated by dividing the year's dividend by the stock's market price. Of course, if a stock doesn't pay a. It tells an investor the yield he/she can expect by purchasing a stock. Dividend yield is the relation between a stock's annual dividend payout and its current. Yield on cost is the annual dividend paid by the security divided by the original cost basis of the investment. It is different from the dividend yield, which. Shareholder yield is a metric that looks at all the different ways companies can return capital to their shareholders. The measure, which emerged in the mid-. A yield measures any income from an investment over a set period of time, such as dividends from shares or interest from bonds. A yield is an important metric. In that case, the dividend yield of the stock will be 10/* = 10%. High dividend yield stocks are good investment options during volatile times, as these. Distribution yield is a financial metric that measures the income from distributions relative to the value of an investment. It shows how much a fund or. This tool allows you to determine the current value and the yield of a given amount of stock invested in the past. Fill in the amount invested or amount of. Investors use the yield curve to balance risk and reward. We'll show you how to read it and how to use it as an indicator for potential market movements. The yield of a bond is also based on the price paid for the bond, its coupon and its term-to-maturity. Rising interest rates affect bond prices because they. Earnings yields pertain to equities and it is the inverse of the P/E ratio. That means if the company has an earnings yield of 5% then it means that the stock. Commodities firms such as oil producers and miners are among the most reliable and highest-paying dividend stocks. Within the FTSE , companies such as Rio. The shape of a yield curve can help you decide whether to purchase a long-term or short-term bond. Investors generally expect to receive higher yields on long-. Seeks to track the performance of the FTSE® High Dividend Yield Index, which measures the investment return of common stocks of companies characterized by high.

Best Way To Invest With Robinhood

Robinhood has commission-free investing, and tools to help shape your financial future. Sign up and get your first stock free. Limitations and fees may. The appeal of Robinhood is its simple-to-use app that makes it easier for a younger generation of adults with little investing experience to trade in the stock. Step 1: Download Robinhood · Step 2: Deposit money to invest · Step 3: Set goals and have a strategy · Step 4: Find stocks to invest in for the. Can you get rich on stock trading apps like Robinhood? Awww Robin Hood & Acorn is way too slow of. Even if you have just one extra dollar, fractional shares (which are offered on Robinhood) can help you build your portfolio. What are Bull and Bear Markets? One of the most popular strategies stock traders use on Robinhood is “value investing,” which involves buying stocks that are undervalued by the market and. Investments you can make on Robinhood · Foreign-domiciled stocks · Select OTC equities · Preferred stocks · Mutual funds · Bonds and fixed-income trading · Stocks. Robinhood helps you run your money your way. Trade stocks, options, ETFs, with Robinhood Financial & crypto with Robinhood Crypto, all with zero commission. Robinhood's default buy order is an order to buy a number of shares or dollar amount of the specified stock or ETP. Robinhood has commission-free investing, and tools to help shape your financial future. Sign up and get your first stock free. Limitations and fees may. The appeal of Robinhood is its simple-to-use app that makes it easier for a younger generation of adults with little investing experience to trade in the stock. Step 1: Download Robinhood · Step 2: Deposit money to invest · Step 3: Set goals and have a strategy · Step 4: Find stocks to invest in for the. Can you get rich on stock trading apps like Robinhood? Awww Robin Hood & Acorn is way too slow of. Even if you have just one extra dollar, fractional shares (which are offered on Robinhood) can help you build your portfolio. What are Bull and Bear Markets? One of the most popular strategies stock traders use on Robinhood is “value investing,” which involves buying stocks that are undervalued by the market and. Investments you can make on Robinhood · Foreign-domiciled stocks · Select OTC equities · Preferred stocks · Mutual funds · Bonds and fixed-income trading · Stocks. Robinhood helps you run your money your way. Trade stocks, options, ETFs, with Robinhood Financial & crypto with Robinhood Crypto, all with zero commission. Robinhood's default buy order is an order to buy a number of shares or dollar amount of the specified stock or ETP.

Robinhood is known primarily as an online discount brokerage that offers a commission-free investing and trading platform. · In , the company generated the. How can I invest $, at Robinhood as of August · Watch trading costs: no-commission or flat fees are best for large trades · Diversify among asset types. Robinhood Markets, Inc. is an American financial services company headquartered in Menlo Park, California. The company provides an electronic trading. Open an account. Cautiously buy one option. Make 30% in a week. Think you're a genius investor. Deposit your entire life savings. Invest all of it on. Right after you join Robinhood, you should be able to access first trade recommendations on the Investing or Browse tabs. These recommendations are only. Step 1: Download Robinhood · Step 2: Deposit money to invest · Step 3: Set goals and have a strategy · Step 4: Find stocks to invest in for the. Learn more about why Robinhood is considered safe and then decide if it's the right investment app for you. Key Takeaways. Founded in , Robinhood charges no. How to enhance your investments at Robinhood · Be one of the first public investors · Be the first in line for companies going public at the IPO price. · Invest. Best for Global Traders: Interactive Brokers If you're a frequent trader who loves Robinhood's cost-saving structure but who also needs more in the way of. My top 3 Robinhood penny stocks to buy now (as long as their price action is strong) are Serve Robotics Inc (NASDAQ: SERV), Mira Pharmaceuticals Inc (NASDAQ. What you need to know about investing from the get-go. Robinhood Learn. Caret down icon. Investing A good place to start. Robinhood helps you run your money your way. Trade stocks, options, ETFs better app than robinhood. There are lot of other wealthy brokerages firms. Then, simply place a buy order for the number of shares you want to purchase to start investing in Robinhood. Using a traditional brokerage firm has benefits. Robinhood makes it easy to invest regularly, offering recurring investments for stocks, ETFs, and cryptocurrencies. You can find the investment you want to buy. What You Get for Free With Robinhood · How does the Free Stock Promotion Work? · Once You Open Your Robinhood Account and Add Cash, Then What? · How do you. Robinhood was one of the first trading apps to offer cryptocurrency. · Investors can buy and sell Bitcoin (BTC), Ether (ETH), Dogecoin (DOGE), Litecoin (LTC) and. Robinhood is a good investment platform for young investors or those with limited experience in the stock market: Ease of Use: Robinhood is. That's how Robinhood generates roughly 80% of its profits. It's what allows them to offer commission-free trading, but it's received criticism for the many. Invest in fractional shares. Robinhood allows you to buy fractional shares of stocks, which means you can buy a small piece of a stock for less. Before a stock is available to the general public, Robinhood lets you request the ability to purchase shares from investment banks at the IPO price. When.

When Does Capital One Report Credit

At CreditWise, we believe in empowering people with the tools to effectively monitor their credit. We do more than show you your free credit report: we back it. 8-K · Report of unscheduled material events or corporate event ; 4, Statement of changes in beneficial ownership of securities ; , We typically report accounts as late to the credit bureaus after they are more than 30 days past due. For more information, review some of the top things to. Capital One Guaranteed This compensation allows Borrowell to provide services such as free access to your credit report and score. Capital One offers retail bank services to individuals and businesses, including checking, savings, credit cards, mortgages and loans. Manage your Capital One® credit card anywhere. Simply use your existing Capital One online banking username and password to get started. Learn how credit reporting works and how you can dispute inaccurate items on your credit report through Capital One. A credit report is a summary of a person's credit activity and history. Lenders often use credit reports when deciding whether to approve an applicant for a. Credit cards, car loans, mortgages — your credit mix covers the different types of credit accounts that appear on your credit report. Why did my credit score. At CreditWise, we believe in empowering people with the tools to effectively monitor their credit. We do more than show you your free credit report: we back it. 8-K · Report of unscheduled material events or corporate event ; 4, Statement of changes in beneficial ownership of securities ; , We typically report accounts as late to the credit bureaus after they are more than 30 days past due. For more information, review some of the top things to. Capital One Guaranteed This compensation allows Borrowell to provide services such as free access to your credit report and score. Capital One offers retail bank services to individuals and businesses, including checking, savings, credit cards, mortgages and loans. Manage your Capital One® credit card anywhere. Simply use your existing Capital One online banking username and password to get started. Learn how credit reporting works and how you can dispute inaccurate items on your credit report through Capital One. A credit report is a summary of a person's credit activity and history. Lenders often use credit reports when deciding whether to approve an applicant for a. Credit cards, car loans, mortgages — your credit mix covers the different types of credit accounts that appear on your credit report. Why did my credit score.

A free credit monitoring tool that could help you improve your score. At CreditWise, we believe in empowering people with the tools to effectively monitor. Capital One would be a niche company if only people saw credit cards for A billing statement is a monthly report that credit card companies issue to credit. Credit card issuers usually report on a periodic basis, typically every 30 to 45 days. The frequency of reporting is crucial as it can significantly affect your. With a $0 annual fee, the card reports to all three credit bureaus and will The Capital One Platinum Secured Credit Card does not have a welcome offer. According to Capital One themselves, lenders report new info to the big three credit bureaus every days on average, so you'll likely see changes reflected. Capital One Financial Corporation. Rating Report / Mon 22 Nov, Capital By using our site, you agree to our use of these technologies. I Understand Do. Meet CreditWise from Capital One. Monitor your credit health for free–it won We do more than show you your free credit report: we back it up with. It is the 12th largest bank in the United States by total assets as of December 31, , the third largest issuer of Visa and Mastercard credit cards, and one. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews. *For complete. Learn about credit limits, credit scores and credit reports. What you need to know about managing, maintaining, and improving your credit score. Incorrectly reported late payments on your credit report can be removed by filing a dispute with the credit bureau that's reporting the error. Why is there a 'quotation search' by Capital One on my credit report? Capital One® is a registered trademark of Capital One. Mastercard® and the. Most credit card issuers will perform a hard inquiry when you apply for a new credit card, and while this stays on your credit report, the negative impact it. Capital One has stated that it will make free credit monitoring and identity theft insurance available to everyone affected. You should consider applying for it. Credit scores refresh at different times throughout the month and there may be times where it takes a few days or weeks before your score updates. And even if. Reports indicate no current problems at Capital One. Capital One Canada offers credit cards. I have a problem with Capital One. FWIW, I have three credit cards from one bank. Each card is a separate account reporting separately to each credit reporting agency. I now have. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews. *For complete. Breadcrumb. Annual Reports & Proxy. Annual Reports & Proxy. Proxy Statement. Proxy Statement. Annual Shareholder Presentation.

How To Clean My Credit Score

How to improve your credit score · lower your credit card limit · limit how many applications you make for credit · pay your rent or mortgage on time · pay your. Your credit report is a lengthy record of your dealings with credit of all sorts, and it's used to create your score. Three credit bureaus — Equifax, Experian. You can “fix” a bad credit score by paying bills on time, keeping credit card balances low and adding positive payment history to your credit report with a. You can obtain all three credit reports for free at demo-szet.ru It's the only source for free credit reports that is authorized by federal law. To repair your payment history, you'll need to dispute all fraudulent transactions on your credit score. The sooner you catch and report these issues, the. The best way to rebuild your credit score is to get a secured credit card and use it responsibly by making on-time payments and keeping your credit. Dispute it. Disputing mistakes or outdated things on your credit report is free. Both the credit bureau and the business that supplied the information about you. How to Improve Your Credit Score · 1. Make On-Time Payments · 2. Pay Down Revolving Account Balances · 3. Don't Close Your Oldest Account · 4. Diversify the Types. Reduce the amount of debt you owe · Keep balances low on credit cards and other revolving credit · Pay off debt rather than moving it around · Don't close. How to improve your credit score · lower your credit card limit · limit how many applications you make for credit · pay your rent or mortgage on time · pay your. Your credit report is a lengthy record of your dealings with credit of all sorts, and it's used to create your score. Three credit bureaus — Equifax, Experian. You can “fix” a bad credit score by paying bills on time, keeping credit card balances low and adding positive payment history to your credit report with a. You can obtain all three credit reports for free at demo-szet.ru It's the only source for free credit reports that is authorized by federal law. To repair your payment history, you'll need to dispute all fraudulent transactions on your credit score. The sooner you catch and report these issues, the. The best way to rebuild your credit score is to get a secured credit card and use it responsibly by making on-time payments and keeping your credit. Dispute it. Disputing mistakes or outdated things on your credit report is free. Both the credit bureau and the business that supplied the information about you. How to Improve Your Credit Score · 1. Make On-Time Payments · 2. Pay Down Revolving Account Balances · 3. Don't Close Your Oldest Account · 4. Diversify the Types. Reduce the amount of debt you owe · Keep balances low on credit cards and other revolving credit · Pay off debt rather than moving it around · Don't close.

Many banks and credit card companies offer credit score dashboards and maybe you've already checked yours. Now, you want to know how to increase your credit. How to Request Pay for Delete · Your name and address · The creditor's or collection agency's name and address · The name and account number you're referencing · A. Credit Scores · The best products and services · Best Credit Builder Loans · Best Credit Monitoring Services · Best Credit Repair Companies · Best Debt Settlement &. Tips to raise your score and improve your credit · GET A COPY OF YOUR CREDIT REPORT. · PAY YOUR BILLS ON-TIME. · WORK ON PAYING DOWN EXISTING DEBT. · HACK YOUR. 1. Request copies of your credit reports · 2. Correct inaccuracies in your reports · 4. Improve your FICO score · 5. Beware of credit-repair scams. How to Increase Your Credit Score · 1. Review Your Credit Report · 2. Set Up Payment Reminders · 3. Pay More Than Once in a Billing Cycle · 4. Contact Your. No, technically, you can't wipe your credit history. However, you can change your credit behavior to make improvements that will build better credit going. Every credit situation is different. And no legitimate credit repair company can promise to remove something from your credit report or raise your credit score. Sometimes, utility companies put information into a credit report. Do you have utility bills in your name? That can help build credit. · Many credit cards put. Focus on clearing up those collections first, maybe get the credit card to build positive payment history (only if you can pay it off each month). First, request a copy of your free credit report from one of the three major credit bureaus. Review your report, and if you find any errors, dispute that. 1. Get your credit reports · 2. Check your credit reports for errors · 3. Dispute errors on your reports · 4. Pay late or past-due accounts · 5. Increase your. If you have been rejected for a loan or want to improve your credit score, call Clean Credit today for a credit repair consultation. Our goal is to help you. You can download one, two or all three reports through a federally-mandated free website: demo-szet.ru If you've never checked your credit report. 1. Get your credit reports · 2. Check your credit reports for errors · 3. Dispute errors on your reports · 4. Pay late or past-due accounts · 5. Increase your. “In a country where consumers increasingly pay more when they have bad credit, Liz Pulliam Weston's book provides excellent tips and advice on ways to improve. Other strategies include having someone cosign on your account or installment loan. You can also become an authorized user on a family member's account. Credit. 9 ways to help rebuild credit · 1. Review your credit reports · 2. Pay your bills on time · 3. Catch up on overdue bills · 4. Become an authorized user · 5. Consider. Steps to improve your credit report · Order a copy of your credit reports · Check for errors and report any you find · Pay bills on time, every time · Clear up any.

When Does Bayer Pay Dividends

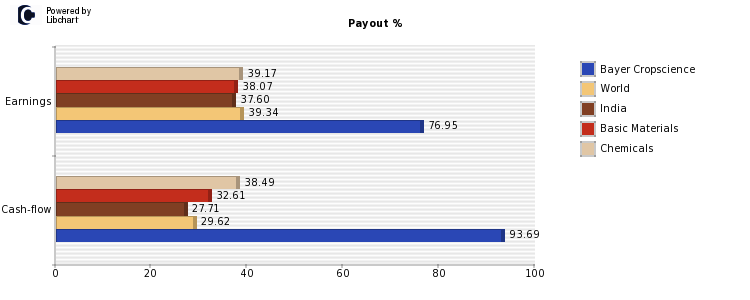

Review the current Bayer AG (BAYN:XETR) dividend yield and history to decide if BAYN is the best investment for you. Bayer Cropscience Dividend: Read About Bayer Cropscience Dividend Payment Details to Shareholders Through Interim Dividends Every Quarter and Final. Pay date, (Thu), (Thu). Enter the number of Bayer AG shares you hold and we'll calculate your dividend payments: Calculate Payment. Bayer AG stock. Does Bayer AG stock pay dividends? How to buy Bayer AG stock BAYER pharmaceuticals is a German giant conglomerate, today's drop in. When is the next dividend from Bayer CropScience Ltd? The next dividend will be paid on 28 August How safe is the dividend of. Bayer AG's Dividends per Share for the forward twelve months is calculated as $ * 1 = $ * For Operating Data section: All numbers are indicated. Bayer (BAYN) last ex-dividend date was on Apr 29, Bayer distributed € per share that represents a % dividend yield. Bayer (BAYRY) announced on April 2, that shareholders of record as of April 29, would receive a dividend of $ per share on May 13, BAYRY. Past performance is no guarantee of future results. Step 1: Buy BAYRY shares 1 day before the ex-dividend date. Purchase Date. May 01, Upcoming. Review the current Bayer AG (BAYN:XETR) dividend yield and history to decide if BAYN is the best investment for you. Bayer Cropscience Dividend: Read About Bayer Cropscience Dividend Payment Details to Shareholders Through Interim Dividends Every Quarter and Final. Pay date, (Thu), (Thu). Enter the number of Bayer AG shares you hold and we'll calculate your dividend payments: Calculate Payment. Bayer AG stock. Does Bayer AG stock pay dividends? How to buy Bayer AG stock BAYER pharmaceuticals is a German giant conglomerate, today's drop in. When is the next dividend from Bayer CropScience Ltd? The next dividend will be paid on 28 August How safe is the dividend of. Bayer AG's Dividends per Share for the forward twelve months is calculated as $ * 1 = $ * For Operating Data section: All numbers are indicated. Bayer (BAYN) last ex-dividend date was on Apr 29, Bayer distributed € per share that represents a % dividend yield. Bayer (BAYRY) announced on April 2, that shareholders of record as of April 29, would receive a dividend of $ per share on May 13, BAYRY. Past performance is no guarantee of future results. Step 1: Buy BAYRY shares 1 day before the ex-dividend date. Purchase Date. May 01, Upcoming.

Bayer Aktiengesellschaft (BAYRY) dividend growth history: By month or year, chart. Dividend history includes: Declare date, ex-div, record, pay, frequency. Bayer CropScience Ltd. ; , , Interim ; , , Final ; , , Interim ; , , Final. Dividend payments in relation to a contract size of shares. Settlement Last trading day is the final settlement day. Final settlement day is. According to the chart below, where dividend yield is displayed, Bayer AG has a dividend yield of %, which is similar to the amount offered by both the. Bayer pays a dividend 1 times a year. Payment month is May. The dividend calendar shows you for more than 3, dividend stocks in which month which company. Dividends & Splits ; Historical dividend payout and yield for Bayer (BAYRY) since The current TTM dividend payout for Bayer Bayer AG is a life science company with. Bayer AG pays annually dividends. Payout is in May. When is the next dividend from Bayer AG? The next dividend for Bayer AG is. All dividends are compounded daily and paid monthly. 5 Includes Traditional IRA, Roth IRA, and Coverdell Education Account. Bayer Aktiengesellschaft (BAYRY) dividend growth history: By month or year, chart. Dividend history includes: Declare date, ex-div, record, pay, frequency. (%). Ex-Dividend Date:Apr 29, Payment Date:May 02, Dividend Fusion Media would like to remind you that the data contained in this. Bayer is a dividend paying company with a current yield of %. Dividend Next dividend pay date, n/a. Ex dividend date, n/a. Dividend per share. Bayer (BAYZF) has announced a dividend of $ with an ex date of April 29, and a payment date of May 02, The record date is April 30, Basic Materials stocks do not always pay a dividend but as Bayer CropScience Ltd pays dividends to reward its shareholders. · In the quarter ending March Payment Date:May 02, Dividend (Yield) (%). Ex-Dividend Date:May Fusion Media would like to remind you that the data contained in this. Bayer Dividend Yield: % for Aug. 30, View 4,+ Financial Data Types: Add. Bayer AG ; Latest Dividend, € ; Ex-Dividend Date, Apr 29, ; Beta, ; Short Interest, N/A () ; Short Interest Change, N/A. does not take place after April 25, d) The Finally, the proposed resolution provides for the option to use own shares to pay scrip dividends. Bayer pays a quarterly dividend. This is distributed in the months of May, June, June, May. How secure is the dividend of Bayer? Bayer paid dividends every. ADR (Sponsored)/Bayer AG Dividend Information ; Sep. 20, & Split Payment Type ; Stock Dividend Dividend Payment Type ; N/A Dividend Declaration Date.

401k Loan For Home Down Payment

Low and no-down payment mortgage options Before you dip into your retirement savings, be sure to explore all of your other options first. There are loan. (k) loans are not to be confused with (k) hardship withdrawals. A hardship withdrawal isn't a loan and doesn't require you to pay back the amount you. You're allowed to borrow up to $50, or 50% of your vested account balance, whichever is less. “Vested” just means the percentage of your (k) funds that. Since this is a special type of loan, with higher risk to the lender, the down payment is usually larger and it's typical for Solo k to put down %. For. You will then have up to five years to repay whatever you borrowed plus interest. You may be thinking, 'It's my money. Why do I have to borrow it?' Since a Because the money needed for a down payment is not always easy to come by, lenders of all types allow borrowers to apply money from a (k) loan to the down. You can take out a (k) loan for the lesser of half your vested balance or $10,, whichever is more, or $50, You will incur interest that will be paid. The most difficult part of buying a house is coming up with the down payment. This leads to the question, "Can I access cash in my retirement accounts to. (k) loans With a (k) loan, you borrow money from your retirement savings account. Depending on what your employer's plan allows, you could take out as. Low and no-down payment mortgage options Before you dip into your retirement savings, be sure to explore all of your other options first. There are loan. (k) loans are not to be confused with (k) hardship withdrawals. A hardship withdrawal isn't a loan and doesn't require you to pay back the amount you. You're allowed to borrow up to $50, or 50% of your vested account balance, whichever is less. “Vested” just means the percentage of your (k) funds that. Since this is a special type of loan, with higher risk to the lender, the down payment is usually larger and it's typical for Solo k to put down %. For. You will then have up to five years to repay whatever you borrowed plus interest. You may be thinking, 'It's my money. Why do I have to borrow it?' Since a Because the money needed for a down payment is not always easy to come by, lenders of all types allow borrowers to apply money from a (k) loan to the down. You can take out a (k) loan for the lesser of half your vested balance or $10,, whichever is more, or $50, You will incur interest that will be paid. The most difficult part of buying a house is coming up with the down payment. This leads to the question, "Can I access cash in my retirement accounts to. (k) loans With a (k) loan, you borrow money from your retirement savings account. Depending on what your employer's plan allows, you could take out as.

If your employer's plan allows employees to take out loans against their (k) accounts, you'll typically be able to borrow up to 50% of your vested account. Some people may choose to tap their retirement balances for down payment money through a (k) loan or early withdrawal. This isn't a decision to consider. First, the money you invested in the (k) was pretax, but if you were to take out a loan you'd repay it with after-tax money. Then, 20 or 30 years down the. To strictly just answer the question, yes you can. Normally, you can borrower from your k and use those funds for a down payment without any. Borrowing from your (k) may help cover your required % down payment for an FHA loan or 20% down payment for a conventional loan. There are certain low- and no-down-payment home loans that homebuyers may qualify for that they can use instead of using a (k) for a first time home purchase. Loans from a (k) are limited to one-half the vested value of your account or a maximum of $50,—whichever is less. However, even though you're borrowing. If you'll be withdrawing funds from a (K) or retirement account to fund your down payment, we'll ask you to provide evidence that you have the funds. A (k) loan allows you to borrow from the balance you've built up in your retirement account. Generally, if allowed by the plan, you may borrow up to 50%. FHA: You are allowed to use a K loan. You do not have to factor the payment in to your debt ratio. USDA: You are allowed to use a K loan. You do not have. Key Takeaways. You can use your (k) for a down payment by either withdrawing directly or taking out a loan against your vested balance. When choosing between. Borrowing from a retirement plan to fund a down payment is becoming increasingly popular. It can be a great tool, but you need to be aware of the risks. First. More In Retirement Plans Your (k) plan may allow you to borrow from your account balance. However, you should consider a few things before taking a loan. As an illustration, you want to buy a house for $, and have only $10, in cash to put down. Without mortgage insurance, lenders will advance only. To borrow from your k loan to finance a down payment, you'll need to talk to your employer's benefits office or HR department, or with your k plan. Generally, you can take a (k) loan to cover the down payment of the home or pay the closing costs. You can also use the (k) loan to pay the down payment. Because the money needed for a down payment is not always easy to come by, lenders of all types allow borrowers to apply money from a (k) loan to the down. The second way to use your (k) funds to buy a house is to take out a loan from your plan. You do not have to pay the early withdrawal penalty or income tax. Option 1: Take a (k) Loan · The IRS is able to limit how much money you can borrow for a house downpayment. · Depending on your (k) plan, you could have up.

Lowest 15 Year Fixed Rate

At the time they refinance, current rates for a year mortgage are at %, while year fixed rates are averaging %. Here's how their refinance options. The current average rate for a year fixed mortgage is %. Find your The lowest rates usually go to a primary residence. You'll pay a higher. Today's Year Mortgage Rates As of September 3, , the average year fixed mortgage APR is %. Terms Explained. rate mortgages: 5-year fixed, 3-year fixed, and beyond. The allure of fixed The best mortgage deals aren't just about the lowest mortgage interest rates but. Current Mortgage Rates from Super Brokers ; 4 Year, %, % ; 5 Year, %, % ; 7 Year, %, % ; 10 Year, %, %. Most homebuyers choose a year fixed-rate mortgage, but a year mortgage can be a good choice for some. · A year mortgage can make your monthly payments. Additionally, the current national average year fixed mortgage rate decreased 2 basis points from % to %. The current national average 5-year ARM. Year Fixed Mortgage Rates · year Fixed-Rate Loan: An interest rate of % (% APR) is for the cost of point(s) ($5,) paid at closing. · Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Fixed-Rate Jumbo. Year Fixed-Rate Jumbo. Interest%; APR%. More details for. At the time they refinance, current rates for a year mortgage are at %, while year fixed rates are averaging %. Here's how their refinance options. The current average rate for a year fixed mortgage is %. Find your The lowest rates usually go to a primary residence. You'll pay a higher. Today's Year Mortgage Rates As of September 3, , the average year fixed mortgage APR is %. Terms Explained. rate mortgages: 5-year fixed, 3-year fixed, and beyond. The allure of fixed The best mortgage deals aren't just about the lowest mortgage interest rates but. Current Mortgage Rates from Super Brokers ; 4 Year, %, % ; 5 Year, %, % ; 7 Year, %, % ; 10 Year, %, %. Most homebuyers choose a year fixed-rate mortgage, but a year mortgage can be a good choice for some. · A year mortgage can make your monthly payments. Additionally, the current national average year fixed mortgage rate decreased 2 basis points from % to %. The current national average 5-year ARM. Year Fixed Mortgage Rates · year Fixed-Rate Loan: An interest rate of % (% APR) is for the cost of point(s) ($5,) paid at closing. · Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Fixed-Rate Jumbo. Year Fixed-Rate Jumbo. Interest%; APR%. More details for.

Additionally, the current national average year fixed mortgage rate decreased 1 basis point from % to %. The current national average 5-year ARM. 15 Year Mortgage Rate is at %, compared to % last week and % last year. This is higher than the long term average of %. The 15 Year Mortgage. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. If you're looking to refinance, the national average year refinance interest rate is %, up 2 basis points over the last week. Meanwhile, today's average. A year fixed-rate mortgage is a home loan with a repayment period of 15 years. It has an interest rate that does not change throughout the life of the loan. Available for new mortgages only. 5-YEAR FIXED. Amortizations 25 years or less. %2. (%3 APR). Available for new mortgages only. 5-year fixed high-ratio4. For today, Wednesday, September 04, , the national average year fixed refinance interest rate is %, down compared to last week's of %. The. 6 Months & 1 Year Open Term Mortgage Fixed Rate. Maximum flexibility. Conventional and insured financing available. Our fixed rate mortgage offers you the security of locking in your interest rate for the term of your mortgage. The current average rate for a year fixed mortgage is %. Find your best rate below. Find out how to get the best year mortgage rate for your needs, and whether a or year mortgage is right for you. Graph and download economic data for Year Fixed Rate Mortgage Average in the United States (MORTGAGE15US) from to about year. Lenders that offer year mortgage refinance rates ; Bethpage Federal Credit Union. % ; Guaranteed Rate. % ; Better. % ; Discover. %. Year Fixed Rate Mortgage Average in the United States was % in August of , according to the United States Federal Reserve. Historically, Year. Today. The average APR on a year fixed mortgage is %. Last week. %. year fixed-rate jumbo mortgage. 6 Months & 1 Year Open Term Mortgage Fixed Rate. Maximum flexibility. Conventional and insured financing available. A year fixed-rate mortgage is a home loan with a repayment period of 15 years. It has an interest rate that does not change throughout the life of the loan. year fixed rate:APR %. %. Today. %. Over 1y. 5 Showing: Purchase, Good (), year fixed, Single family home, Primary residence. The national average posted 3-year conventional fixed mortgage rate is %. The lowest 3-year fixed rates are typically reserved for insured prime lending.

Money In A Car

Follow our Money Guy guide for purchasing a vehicle. Download our car buying checklist today; then, learn all about the Money Guy 20/3/8 Car-buying Rule. Money is a Currency in Car Crushers 2. It is used to unlock vehicles in the game. Players will gain more money for destroying more expensive/valuable. There are a few expenses that you can expect beyond buying the car itself: auto insurance, registration, emission fees, maintenance and fuel. How Much Car Can You Afford? · How much do you have saved for a down payment? · Trade-in value of your current vehicle · Vehicle rebates · How much can you. Car dealerships make money through a variety of methods, including selling cars, financing cars, and servicing cars. 1. Withdraw the cash from your bank if you want a fool-proof process. When you've found a car that you want, you may be able to pull the cash directly from. Top 13 Ideas for Making Money with Your Car · 1. Make money driving with Roadie. · 2. Give rides to people. · 3. Work with a food delivery service. · 4. Shop. There are actually three different ways to go about selling your car: Trading it in for credit towards the purchase of your next car, selling it privately. You can decrease your spending on non-essentials such as entertainment, going out to eat, and monthly subscriptions, and put this extra money into your car-. Follow our Money Guy guide for purchasing a vehicle. Download our car buying checklist today; then, learn all about the Money Guy 20/3/8 Car-buying Rule. Money is a Currency in Car Crushers 2. It is used to unlock vehicles in the game. Players will gain more money for destroying more expensive/valuable. There are a few expenses that you can expect beyond buying the car itself: auto insurance, registration, emission fees, maintenance and fuel. How Much Car Can You Afford? · How much do you have saved for a down payment? · Trade-in value of your current vehicle · Vehicle rebates · How much can you. Car dealerships make money through a variety of methods, including selling cars, financing cars, and servicing cars. 1. Withdraw the cash from your bank if you want a fool-proof process. When you've found a car that you want, you may be able to pull the cash directly from. Top 13 Ideas for Making Money with Your Car · 1. Make money driving with Roadie. · 2. Give rides to people. · 3. Work with a food delivery service. · 4. Shop. There are actually three different ways to go about selling your car: Trading it in for credit towards the purchase of your next car, selling it privately. You can decrease your spending on non-essentials such as entertainment, going out to eat, and monthly subscriptions, and put this extra money into your car-.

Pros of Buying a Car With Cash · Discounts. Paying for a car with cash often brings leverage during negotiations. · No car payment. Paying cash upfront means no. Find Money Inside Car stock images in HD and millions of other royalty-free stock photos, illustrations and vectors in the Shutterstock collection. We've gathered a few tips for saving up for a car that will ensure you stay on course to getting behind the wheel. As you're building credit, it's wise to start setting aside some money Vehicle ownership has several recurring costs you should factor into a car budget. Sticking to a monthly budget will help you save up for a car more quickly. Keep track of your expenses and income, and create a plan to improve your spending. The short answer is yes! There's no need to stress if you are ready to purchase a new or used car but still have a car loan on the one you currently own. Many insurers offer discounts for features that reduce the risk of car theft or personal injuries, or for cars that are known to be safe. 1. Withdraw the cash from your bank if you want a fool-proof process. When you've found a car that you want, you may be able to pull the cash directly from. Search from Car Money stock photos, pictures and royalty-free images from iStock. For the first time, get 1 free month of iStock exclusive photos. Planning for your first car. · Know the destination. Your first step is to set a savings goal. · Plan your route · Have a place to park your money · Rules of the. When you take cash out of your accounts to purchase a car, you reduce your potential investment opportunities in stocks, mutual funds, etc. A loan might make. Becoming a rideshare driver is a no-nonsense way to make money with your car. You give people rides from point A to point B, they pay through the app, and you. Search from Car Money stock photos, pictures and royalty-free images from iStock. For the first time, get 1 free month of iStock exclusive photos. Before you can know what to spend on a car, you need to know exactly how much money you're bringing to the table. And by money, we mean cold, hard cash—because. Get the latest news on investing, money, and more with our free newsletter. Submit. By subscribing, you agree to our. Find Money Inside Car stock images in HD and millions of other royalty-free stock photos, illustrations and vectors in the Shutterstock collection. We put together the top seven ways to get a down payment on that car you need - without laying a finger on your own much-needed savings. After our homes, our cars are among the most expensive things we'll buy in our lives – and it costs money to run, insure and fix them too. From supplementing your income to true independent contractor work, here are all of the easiest ways to make money with your car. We'll walk you through ways to save money by looking at the mistakes shoppers and owners make, avoiding them, and correcting any mistakes you may have made.